Do you have Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud? If yes, then this article is for you. We are going to cover all the aspects of Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud. So if you are interested to know more about Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud, read on.

Editor's Notes: Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud recently published on date. The topic is important because of its use in various business, personal and other purposes.

Our analysts have analyzed Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud. Based on the analysis and digging various information, we have put together this Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud guide to help you benefit.

Here are the key differences or key takeaways:

| Key | Differences/Takeaways |

|---|---|

| Importance | Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud is a very important topic. |

| Benefits | Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud provides many benefits. |

FAQ

This comprehensive FAQ section provides detailed answers to frequently asked questions regarding the 2025 VAT Refund. By addressing common queries, this guide aims to enhance your understanding of the process and assist you in navigating the application procedures seamlessly.

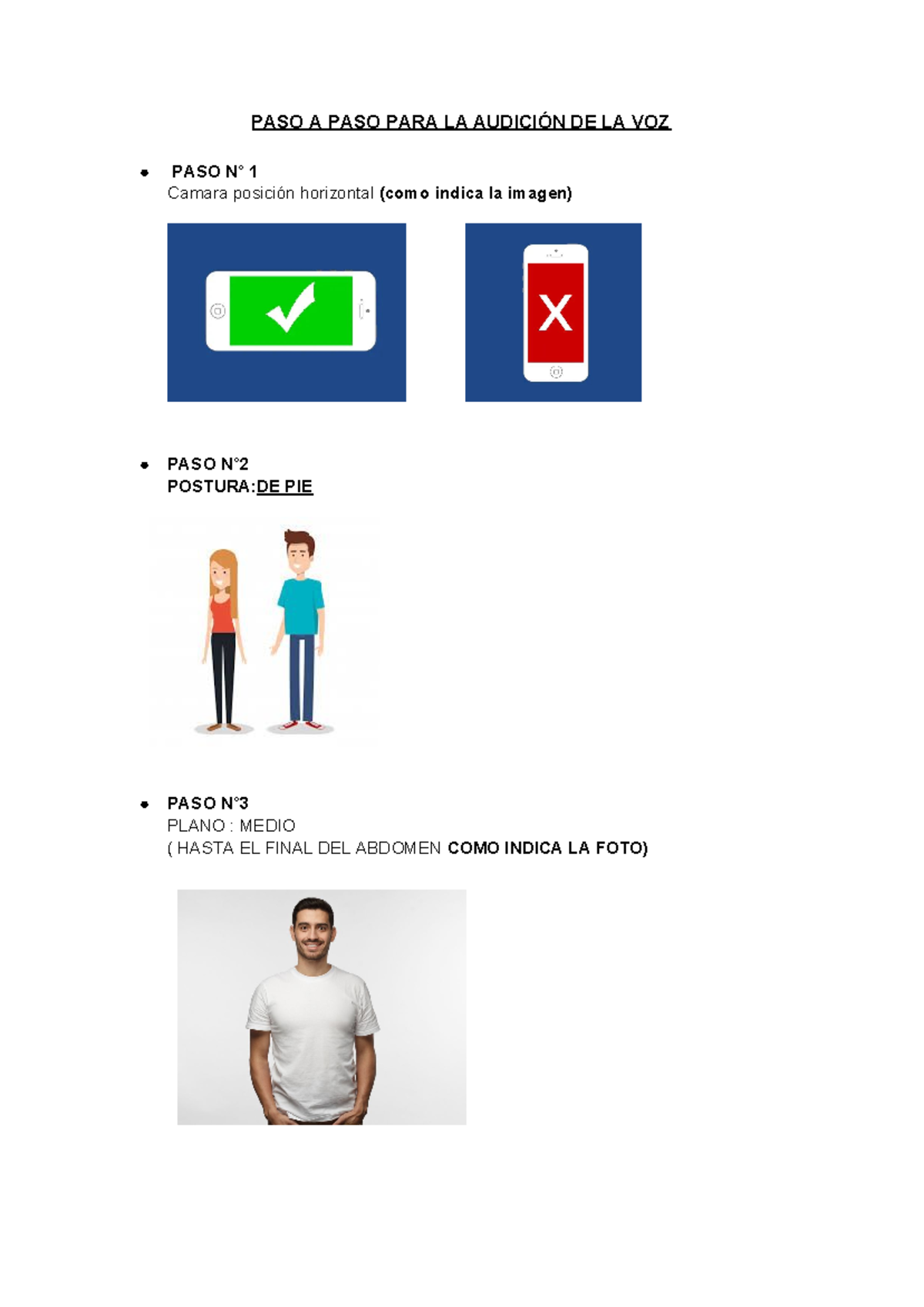

PASO A PASO PARA AudicióN DE LA VOZ - Lenguaje y Comunicación - PASO A - Source www.studocu.com

Question 1: What is the eligibility criteria for claiming the 2025 VAT Refund?

To be eligible for the refund, individuals must meet the following criteria:

- Have paid VAT on purchases made within the European Union (EU).

- Not be a resident of the EU.

- Have spent a minimum amount on eligible purchases, as determined by individual EU member states.

Question 2: How can I apply for the 2025 VAT Refund?

Applications for the refund can be submitted through designated online portals or via paper forms at border crossings or authorized refund points. The specific application process may vary depending on the country in which the purchases were made.

Question 3: What documentation is required for the refund application?

To support the refund application, individuals are typically required to provide original receipts, invoices, or other proof of purchase, along with a valid passport and proof of non-EU residency, such as a visa or residence permit.

Question 4: What are the processing times and refund methods for successful applications?

The processing times for VAT refund applications can vary depending on the country handling the claim, but generally range from several weeks to a few months. Refunds are typically issued via bank transfer or in the form of a cheque mailed to the applicant's provided address.

Question 5: Are there any restrictions on the types of purchases eligible for the refund?

The eligibility of purchases for VAT refunds may vary between EU member states, but common categories include:

- Goods purchased in physical stores

- Online purchases delivered to a non-EU address

- Certain services, such as hotel accommodations and restaurant meals

Exclusions may apply for specific items, such as food, beverages, and tobacco products.

Question 6: Can I apply for the refund if I have already left the EU?

Yes, individuals have a specific timeframe after departing from the EU to submit their refund application. The duration varies by country, but typically ranges from three months to up to one year. It is recommended to consult the relevant authorities for country-specific regulations.

By understanding these common questions and answers, individuals seeking VAT refunds in 2025 can navigate the process more effectively, maximizing their refund claims.

Refer to the comprehensive guide for further insights and detailed instructions on applying for the 2025 VAT Refund.

Tips on Claiming VAT Refund in 2025

The Value-Added Tax (VAT) refund process is a crucial aspect for businesses to recover eligible taxes. To ensure a smooth and successful claim, it's essential to understand the process and follow the necessary steps. This guide provides a comprehensive overview of how to navigate the VAT refund process, offering valuable tips to enhance your experience.

Tip 1: Familiarize Yourself with Eligibility Criteria:

Eligibility is a key factor in determining the success of your refund claim. Ensure that your business meets the criteria set by the tax authorities. Study the regulations and consult with experts if needed to establish your eligibility.

Tip 2: Gather Required Documentation:

Documentation serves as evidence to support your refund claim. Keep accurate records of all eligible expenses and transactions. Invoices, receipts, and bank statements are essential documents that provide a clear trail of your business activities.

Tip 3: File on Time:

Timeliness plays a vital role in the refund process. Adhere to the deadlines set by the tax authorities to avoid delays and potential penalties. Mark your calendars and set reminders to ensure timely filing.

Tip 4: Utilize Digital Platforms:

Many countries offer online platforms for VAT refund claims. These platforms provide convenience, accuracy, and efficiency. Explore the available options and leverage technology to simplify the process.

Tip 5: Seek Expert Guidance:

If you face complexities or uncertainties in the process, consider seeking professional assistance from a tax advisor or accountant. Their expertise can help you navigate the regulations, maximize your claim, and ensure compliance.

Tip 6: Keep Up-to-Date with Regulations:

VAT regulations are subject to changes over time. Stay informed about any updates or amendments to ensure that your refund claims align with the latest requirements. Refer to official sources and consult with experts to stay abreast of the evolving landscape.

Tip 7: Track Your Refund Status:

After submitting your claim, track its progress regularly. Many countries provide online portals or mobile applications that allow you to monitor its status. This proactive approach enables you to identify any delays or issues promptly.

Tip 8: Understand Refund Payment Methods:

VAT refunds can be disbursed through various methods, such as bank transfers, checks, or credit to your tax account. Familiarize yourself with the available options and provide the necessary information to facilitate a seamless receipt of your refund.

By following these tips, you can streamline the VAT refund process, increase your chances of a successful claim, and maximize your refund amount. Remember to consult with experts if needed and stay informed about the latest regulations. Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud can provide further insights and guidance on navigating the process in specific countries.

Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud

Understanding the process for requesting and verifying VAT refunds is essential for businesses to effectively manage their finances and cash flow. Six key aspects to consider in this regard include eligibility criteria, application procedures, supporting documentation, processing timelines, potential challenges, and available support channels.

- Eligibility Criteria: Determine if your business meets the requirements for claiming VAT refunds.

- Application Procedures: Familiarize yourself with the steps involved in submitting a VAT refund request.

- Supporting Documentation: Gather all necessary documentation to support your refund claim.

- Processing Timelines: Understand the estimated timeframes for processing refund applications.

- Potential Challenges: Anticipate and prepare for any potential roadblocks or delays in the refund process.

- Support Channels: Identify available resources and channels for obtaining assistance with refund-related queries.

Paso a paso para la atención integral del paciente Ana lucia - Paso a - Source www.studocu.com

By considering these aspects, businesses can proactively address the requirements and challenges associated with VAT refund claims, ensuring timely and accurate processing. Proper understanding of eligibility criteria, meticulous preparation of supporting documentation, and effective utilization of available support channels contribute to the smooth and successful management of VAT refunds.

Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud

La "Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud" es una completa guía interactiva que combina texto informativo y enlaces a recursos adicionales para ayudar a los lectores a comprender y procesar la devolución del IVA en 2025. Explora en profundidad los aspectos clave del proceso de solicitud, proporcionando instrucciones paso a paso, ejemplos prácticos, tablas informativas y una plataforma de comentarios y preguntas para el compromiso directo del lector. Esta guía se ha creado para ayudar a los individuos y a las empresas a reclamar eficazmente sus devoluciones de IVA, garantizando el cumplimiento de las normas y la máxima recuperación.

El Atlético Paso y Toyota Canarias renuevan su compromiso para la - Source atleticopaso.club

Esta guía informativa es un recurso esencial para quienes buscan orientación sobre la devolución del IVA en 2025. Proporciona una comprensión integral del proceso, desde la elegibilidad hasta la documentación requerida, y aborda los retos comunes asociados con la presentación de solicitudes. Además, la guía destaca los cambios y actualizaciones clave en las regulaciones del IVA para 2025, capacitando a los lectores con los conocimientos más recientes.

El valor práctico de esta guía radica en su capacidad para simplificar el complejo proceso de devolución del IVA, permitiendo a los individuos y a las empresas maximizar sus devoluciones. Al proporcionar instrucciones paso a paso y recursos de apoyo, la guía fomenta la confianza y reduce las posibilidades de errores en la solicitud. Además, la plataforma de comentarios y preguntas permite a los lectores interactuar directamente, aclarando cualquier duda o inquietud que puedan tener.

| Chapter 1 | Chapter 2 | Chapter 3 |

|---|---|---|

| Introduction: Understanding the VAT Refund Process | Step-by-Step Guide to VAT Refund Application | Common Challenges and Solutions in VAT Refund |

| Eligibility Criteria and Required Documentation | Online VAT Refund Portal and Application Procedure | Impact of Digitalization on VAT Refund |

| Updates and Changes in VAT Refund Regulations | Timeline and Processing of VAT Refunds | Case Studies and Real-Life VAT Refund Successes |

Conclusion

En resumen, la "Devolución Del IVA 2025: Guía Paso A Paso Para La Consulta Y Solicitud" es una herramienta invaluable que proporciona orientación completa y apoyo práctico para la devolución del IVA en 2025. Al desmitificar el proceso y capacitar a los lectores con el conocimiento necesario, esta guía garantiza que puedan reclamar eficazmente sus devoluciones de IVA, maximizando sus recuperaciones y cumpliendo con las normas reglamentarias. Entender la devolución del IVA es esencial para navegar por el panorama fiscal en constante cambio. Esta guía representa un paso proactivo hacia el fortalecimiento del conocimiento y la gestión eficaz del IVA en 2025.

A medida que nos acercamos al 2025, es fundamental mantenerse actualizado sobre los últimos cambios en las regulaciones del IVA. La guía sirve como un recurso continuo, proporcionando actualizaciones y aclaraciones sobre nuevas políticas y procedimientos. Al aprovechar esta guía, los individuos y las empresas pueden mantenerse informados, navegar sin problemas por el proceso de devolución del IVA y maximizar su recuperación financiera.