Unlocking the Secrets of "Tax Optimisation Through Virement Fisc: A Comprehensive Guide"

- Understand the concept of virement fisc and its application in international tax planning.

- Learn about the benefits and limitations of using virement fisc.

- Identify the eligibility criteria and documentation requirements for virement fisc.

- Explore case studies and practical examples of virement fisc in action.

- Gain insights into the legal and regulatory framework surrounding virement fisc.

- Develop strategies to mitigate risks and ensure compliance with tax authorities.

- Introduction to Virement Fisc

- Benefits and Limitations of Virement Fisc

- Eligibility Criteria and Documentation Requirements

- Case Studies and Practical Examples

- Legal and Regulatory Framework

- Strategies for Risk Mitigation and Compliance

- Conclusion

Maximize Tax Deductions with USLVICC Donations - Source gamma.app

FAQs

This comprehensive FAQ section aims to clarify any lingering questions or uncertainties regarding Tax Optimisation Through Virement Fisc.

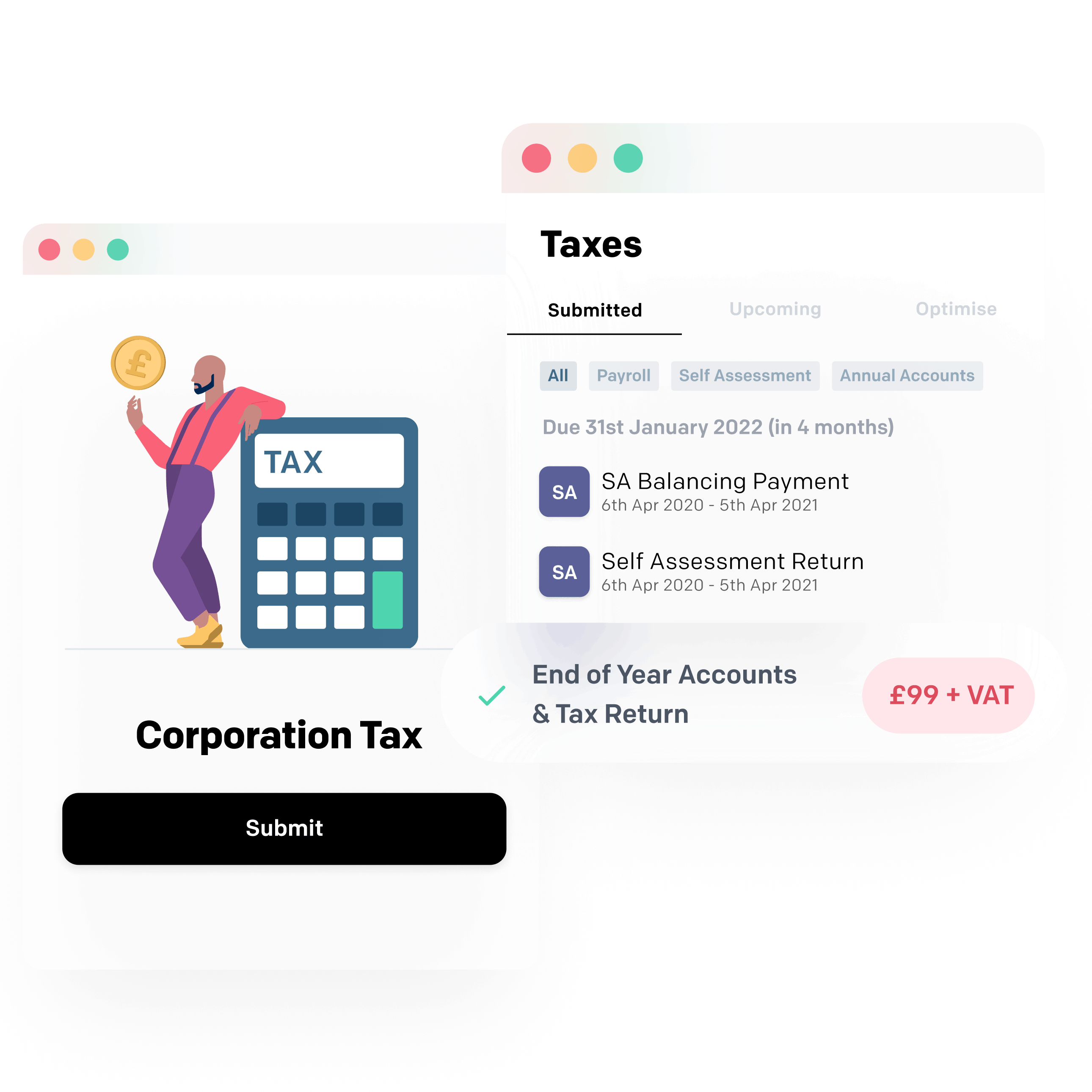

Tax Optimisation - Source ember.co

Question 1: What is the primary objective of Virement Fisc?

Answer: Virement Fisc primarily aims to streamline tax payments and reduce the overall tax burden for businesses operating in multiple jurisdictions.

Question 2: How can Virement Fisc assist in optimising tax payments?

Answer: By centralising the management of tax payments across various jurisdictions, Virement Fisc enables businesses to leverage economies of scale and secure favourable tax rates, leading to optimised tax payments.

Question 3: Is Virement Fisc legally compliant?

Answer: Yes, Virement Fisc is fully compliant with all applicable tax laws and regulations. It adheres to the principles of transparency and legal compliance, ensuring businesses operate within the boundaries of the law.

Question 4: What are the benefits of utilising Virement Fisc?

Answer: Businesses that implement Virement Fisc gain access to tax savings, simplified tax management, reduced compliance risks, and improved cash flow forecasting.

Question 5: Is Virement Fisc only suitable for large multinational corporations?

Answer: No, Virement Fisc can be beneficial for businesses of all sizes operating across borders. It offers tailored solutions that meet the specific needs of each business.

Question 6: What are the essential considerations before implementing Virement Fisc?

Answer: Prior to implementing Virement Fisc, businesses should carefully analyse their tax obligations, cross-border operations, and compliance requirements to ensure it aligns with their tax optimisation strategy.

In summary, Virement Fisc offers a comprehensive solution for tax optimisation and compliance management. It empowers businesses to navigate the complexities of international tax laws and maximise tax efficiency while maintaining legal adherence.

To delve deeper into the subject, refer to the following article section, "Benefits of Virement Fisc".

Tips

This "Tax Optimisation Through Virement Fisc: A Comprehensive GuideTax Optimisation Through Virement Fisc: A Comprehensive Guide" provides valuable tips to individuals and corporations seeking to optimize their tax strategies through virement fisc. By understanding the intricacies of tax laws and implementing these strategies, one can potentially reduce their tax liabilities.

Tip 1: Utilize Tax-Efficient Investments

Consider investing in tax-advantaged accounts, such as retirement funds or tax-free savings plans, which offer tax deferral or tax-free growth on investment earnings.

Tip 2: Optimize Business Structures

Choose the most tax-efficient business structure for your operations, taking into account factors such as liability, tax rates, and shareholder distributions.

Tip 3: Leverage Tax Credits and Deductions

Thoroughly research and take advantage of available tax credits and deductions, such as research and development expenses, charitable contributions, and home office deductions.

Tip 4: Implement Transfer Pricing Strategies

Optimize the allocation of profits and expenses among related entities within a corporate group to minimize overall tax liability through transfer pricing mechanisms.

Tip 5: Seek Professional Advice

Consult with qualified tax professionals, such as accountants or tax attorneys, to ensure compliance with tax regulations and to develop customized tax optimization strategies.

Tip 6: Utilize Tax Treaties

If operating internationally, leverage tax treaties to avoid double taxation and optimize tax credits.

Tip 7: Plan for Tax Audits

Maintain proper documentation and records to support tax deductions and prepare for potential tax audits to minimize the risk of penalties.

Tip 8: Stay Updated on Tax Laws

Stay informed about changes in tax laws and regulations to adapt tax strategies accordingly and remain compliant.

By implementing these tips, individuals and corporations can potentially optimize their tax strategies, reduce tax liabilities, and enhance their overall financial position.

Tax Optimisation Through Virement Fisc: A Comprehensive Guide

Effective tax optimisation involves meticulous planning, with virement fisc emerging as a strategic approach to enhance financial efficiency. This guide presents six essential aspects to consider when leveraging virement fisc for tax optimisation.

- Legal Framework: Understanding the legal framework governing virement fisc is crucial, ensuring compliance and maximising benefits.

- Tax Base Consolidation: Virement fisc allows for consolidating tax bases across group entities, optimising the allocation of tax losses and credits.

- Intercompany Transactions: Managing intercompany transactions effectively using virement fisc can minimise tax liabilities and streamline financial flows.

- Cross-Border Considerations: Virement fisc can facilitate cross-border tax optimisation, leveraging tax treaties and reducing withholding taxes.

- Timing and Planning: Strategic timing and planning are essential to maximise the benefits of virement fisc, aligning tax payments with business operations.

Tax optimisation through virement fisc requires a comprehensive understanding of these key aspects. By considering legal frameworks, tax base consolidation, intercompany transactions, cross-border implications, and timing, businesses can effectively utilise virement fisc to enhance financial efficiency and reduce tax liabilities.

Tax Optimisation Through Virement Fisc: A Comprehensive Guide

Tax optimisation through virement fisc is a specialised and nuanced strategy that involves a deep understanding of the tax laws and regulations governing the transfer of assets and income between related companies within a corporate group. Virement fisc, which translates to "tax transfer" in English, allows companies to optimise their tax burdens by strategically shifting profits and losses within their group structure. Understanding this concept is crucial for businesses seeking to strategically manage their tax liabilities.

Expat Tax Optimisation in Switzerland - Source www.iwp.ch

A practical example of virement fisc in action is when a parent company transfers a portion of its profits to a subsidiary in a jurisdiction with a lower corporate tax rate. This transfer reduces the tax liability of the parent company and takes advantage of the lower tax rate applicable to the subsidiary. Another example involves shifting losses from a struggling subsidiary to a profitable one, offsetting the losses and reducing the overall tax burden of the group.

The practical significance of understanding virement fisc lies in its potential to reduce a corporate group's overall tax liability. By optimising the allocation of profits and losses within the group, companies can minimise their tax payments and maximise their profitability. It is essential to note, however, that virement fisc must comply with legal and regulatory requirements to avoid violating anti-avoidance rules.

| Concept | Importance |

|---|---|

| Strategic profit and loss transfer within corporate groups | Optimises tax burden by shifting profits to lower tax jurisdictions and offsetting losses |

| Legal and regulatory compliance | Ensures virement fisc practices adhere to anti-avoidance rules |

| Potential for significant tax savings | Reduces overall tax liability for the corporate group |

Conclusion

Tax optimisation through virement fisc is a valuable strategy for corporate groups seeking to minimise their tax liabilities and maximise their profitability. It involves a comprehensive understanding of tax laws and regulations, careful planning, and compliance with legal and regulatory requirements. By embracing virement fisc principles, businesses can optimise their tax burdens and gain a competitive edge in today's globalised economy.

As businesses navigate the complexities of international tax regulations, virement fisc will continue to play a vital role in tax optimisation strategies. Continued vigilance in staying abreast of regulatory changes and leveraging the expertise of tax professionals will be essential for businesses to harness the full benefits of virement fisc while maintaining compliance.