The question of carbon pricing and its potential to mitigate climate change has been a subject of intense debate in recent years. To shed light on this complex issue, "The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation" was published to provide comprehensive insights into carbon taxation, its implications, and its role in combating climate change.

Editor's Notes: "The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation" was published yesterday, and it offers a timely exploration of this critical topic. In an era marked by escalating global temperatures and increasingly frequent extreme weather events, understanding the potential of carbon taxation to mitigate climate change is essential.

Through meticulous analysis and extensive research, "The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation" presents a comprehensive overview of carbon taxation, its economic and environmental implications, and its potential to drive transformative change towards a low-carbon future.

Key Differences or Key Takeaways

| Aspect | Key Takeaway |

|---|---|

| Carbon Pricing Mechanisms | Explores various forms of carbon pricing, including carbon taxes, cap-and-trade systems, and emissions trading schemes, providing a comprehensive understanding of their respective advantages and disadvantages. |

| Economic Implications | Examines the economic effects of carbon taxation on industries, businesses, and consumers, assessing its impact on competitiveness, innovation, and economic growth. |

| Environmental Impacts | Evaluates the effectiveness of carbon taxation in reducing greenhouse gas emissions, promoting renewable energy development, and transitioning to a sustainable, low-carbon economy. |

| Political and Social Considerations | Discusses the political and social challenges associated with implementing carbon taxation, exploring public perceptions, equity concerns, and the role of government in driving change. |

| International Perspectives | Compares carbon pricing policies and experiences across different countries and regions, providing insights into best practices and lessons learned. |

Transition to main article topics

The main article of "The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation" delves into the following topics:

- The scientific basis of climate change and the urgent need for action.

- The role of carbon pricing in reducing greenhouse gas emissions and mitigating climate change.

- The economic, environmental, and social impacts of carbon taxation.

- The political and practical challenges of implementing carbon taxation.

- Case studies of successful carbon pricing initiatives around the world.

- Recommendations for effective carbon pricing policies.

FAQ

This comprehensive FAQ section provides succinct responses to commonly raised questions and misconceptions regarding carbon taxation and its implications for climate change mitigation.

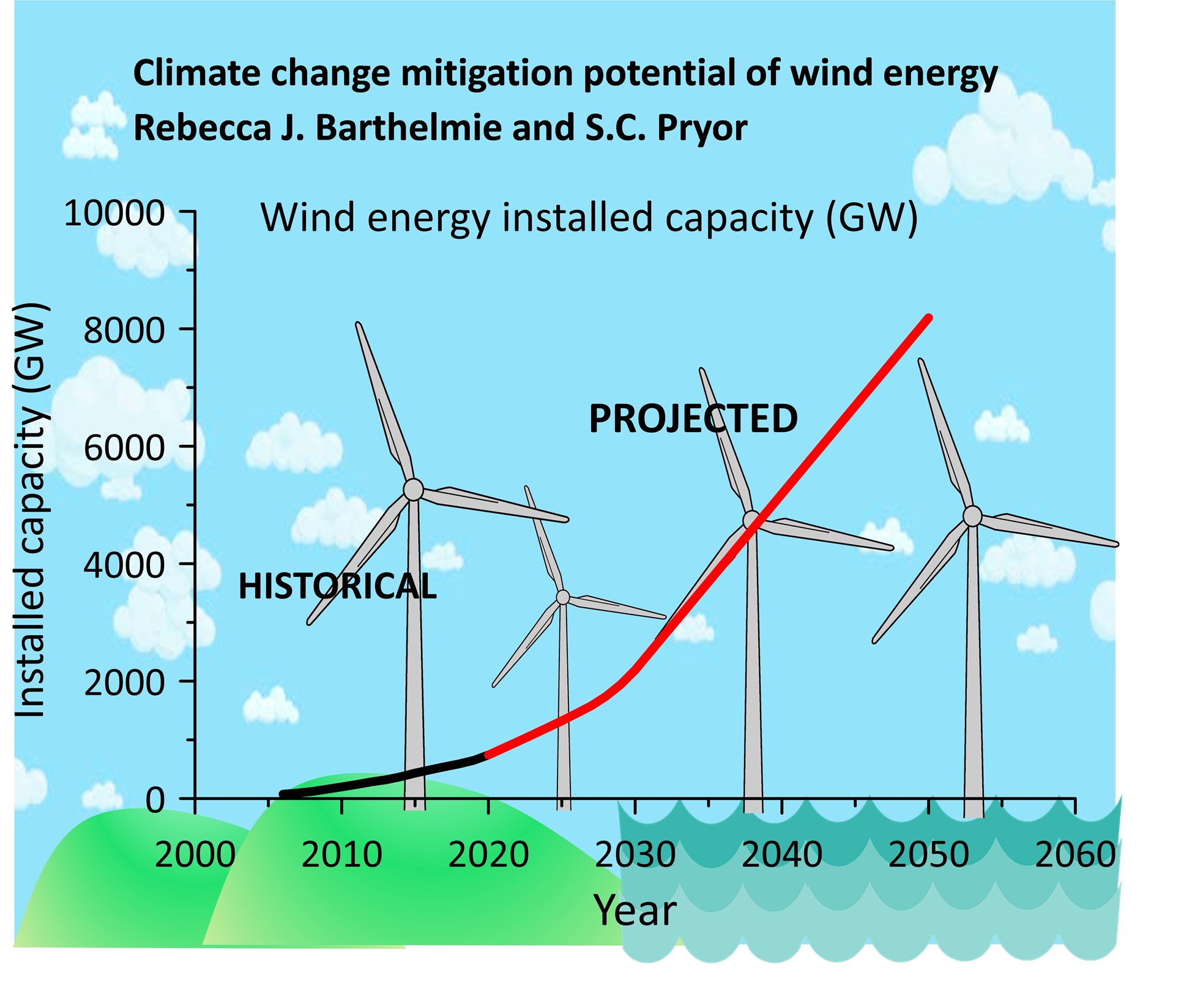

Climate Change Mitigation Potential of Wind Energy | https - Source climatemodeling.science.energy.gov

Question 1: What is carbon taxation and how does it work?

Carbon taxation is an economic instrument that imposes a fee on the emission of carbon dioxide and other greenhouse gases. By making emitting greenhouse gases more expensive, carbon taxation encourages businesses and individuals to reduce their emissions and shift towards cleaner energy sources.

Question 2: What are the benefits of carbon taxation?

Carbon taxation offers numerous benefits, including promoting innovation in low-carbon technologies, reducing air pollution, and generating revenue that can be used to support environmental protection and clean energy initiatives.

Question 3: How can carbon taxation address climate change?

By making it more expensive to emit greenhouse gases, carbon taxation creates incentives for businesses and individuals to reduce their emissions. This, in turn, helps mitigate the effects of climate change by reducing the amount of greenhouse gases released into the atmosphere.

Question 4: What are the challenges associated with implementing carbon taxation?

Implementing carbon taxation can pose challenges, such as ensuring fair and equitable distribution of costs, addressing potential economic impacts, and overcoming political resistance. However, these challenges can be addressed through careful planning, public consultation, and political compromise.

Question 5: Is carbon taxation an effective tool for reducing emissions?

Evidence suggests that carbon taxation can be an effective tool for reducing greenhouse gas emissions. Studies have shown that carbon taxation has led to significant emission reductions in various countries and industries.

Question 6: What are the alternatives to carbon taxation?

Other approaches to address climate change include cap-and-trade systems, renewable energy subsidies, and energy efficiency regulations. The choice of the most appropriate approach depends on specific circumstances and policy objectives.

In summary, carbon taxation presents a promising approach to mitigate climate change by making greenhouse gas emissions more expensive and encouraging the transition towards cleaner energy sources. While challenges exist in its implementation, careful planning and political compromise can pave the way for successful carbon taxation policies.

Next Article Section:...

Tips

The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation introduces myriad strategies for implementing carbon taxation effectively. Here are some key tips to consider:

Tip 1: Set an Appropriate Carbon Price:

Establishing a suitable carbon price is crucial. A price that is too low might not sufficiently deter emissions, while a price that is excessively high could harm businesses and consumers. Research and analysis are necessary to determine the optimal price that balances environmental protection and economic feasibility.

Tip 2: Implement a Comprehensive Coverage Plan:

Ensuring that the carbon tax applies to all significant emission sources is essential. A comprehensive plan should encompass all sectors, including power generation, transportation, and manufacturing. Targeted exemptions or exclusions should be carefully evaluated and justified.

Tip 3: Provide Transition Support for Affected Industries:

Carbon taxation can impact certain industries disproportionately. Providing transitional support, such as tax credits or grants, can help mitigate the economic burden during the adjustment phase. This support enables industries to invest in low-carbon technologies and adapt to the new pricing structure.

Tip 4: Use Revenue Wisely:

The revenue generated from carbon taxation should be utilized strategically. Investing the funds in clean energy research, renewable energy projects, and green infrastructure helps accelerate the transition towards a low-carbon economy. Transparent and accountable management of the revenue is crucial to maintain public trust.

Tip 5: Monitor and Evaluate Progress:

Regular monitoring and evaluation of the carbon tax's impact are vital. Tracking emission reductions, economic effects, and the overall effectiveness of the policy helps identify areas for improvement and ensures that the tax remains aligned with climate change mitigation goals.

By implementing these tips, governments can design and implement carbon taxation policies that effectively reduce greenhouse gas emissions, promote economic growth, and foster a more sustainable future.

The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation

Governments are increasingly utilizing carbon taxation as a crucial strategy to mitigate climate change. This comprehensive guide explores the essential aspects of carbon taxation, examining how it influences greenhouse gas emissions, promotes innovation, and contributes to economic growth.

- Carbon Pricing:

- Emission Reduction:

- Innovation Catalyst:

- Revenue Generation:

- Equity Considerations:

- Global Collaboration:

Carbon taxation schemes aim to internalize the costs of carbon pollution, driving down emissions by making it more expensive to use fossil fuels. It also encourages innovation in clean energy technologies and processes, creating new economic opportunities. The revenue generated can fund green initiatives and support affected industries. However, it's important to address equity concerns, ensuring that low-income households are not disproportionately impacted. Global collaboration is essential for enhancing the effectiveness of carbon taxation.

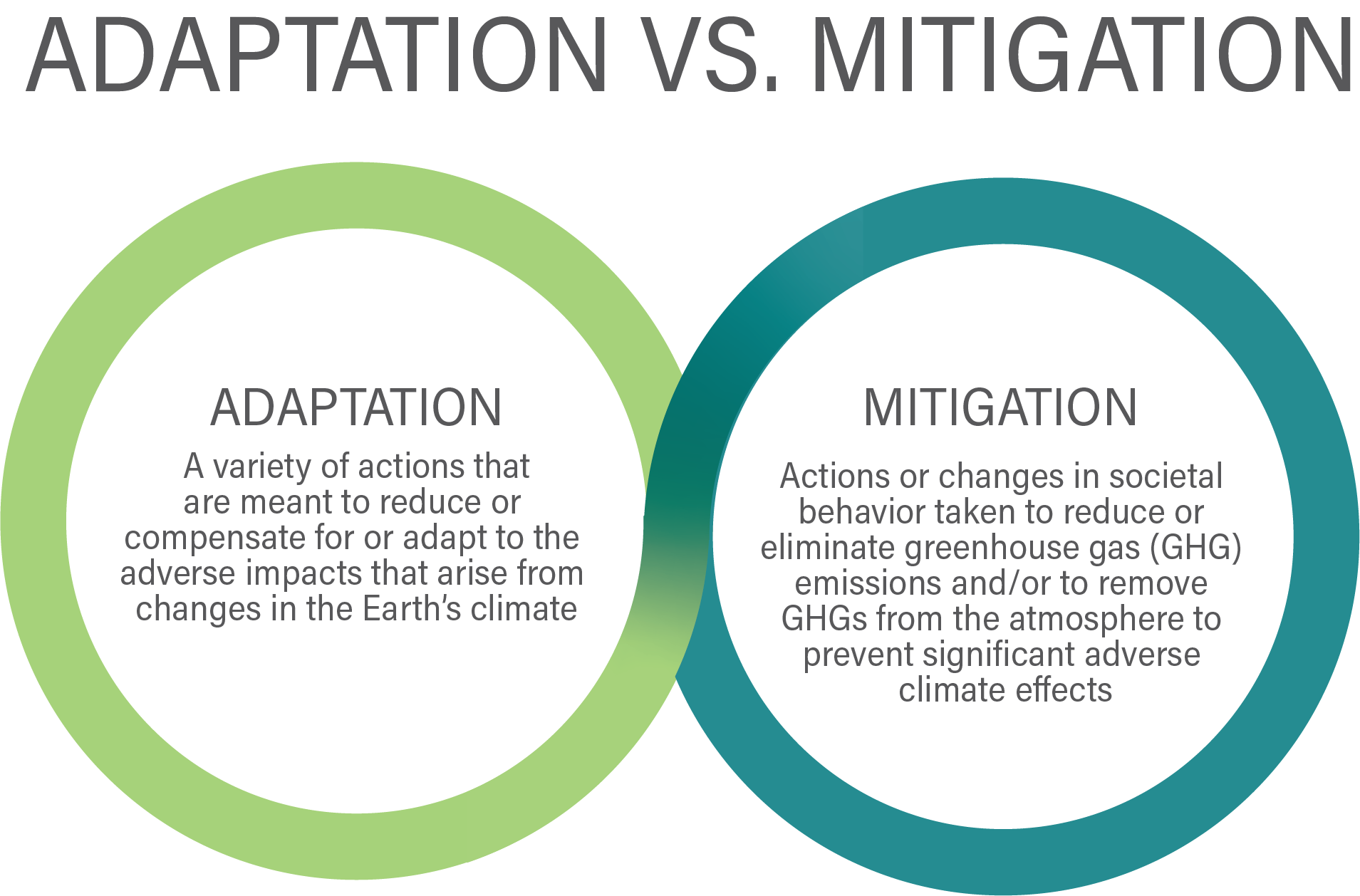

Climate Change: Vulnerability, Risk, and Adaptation vs Mitigation - EA - Source eaest.com

The All-Encompassing Guide To Carbon Taxation: Understanding Its Impact On Climate Change Mitigation

As global concerns over climate change intensify, the need for effective strategies to curb greenhouse gas emissions becomes paramount. Carbon taxation, a policy that levies a fee on carbon emissions, has emerged as a promising tool to address this critical issue. "The All-Encompassing Guide to Carbon Taxation: Understanding Its Impact on Climate Change Mitigation" provides a comprehensive overview of this complex topic, exploring its mechanisms, effects, and significance in combating climate change.

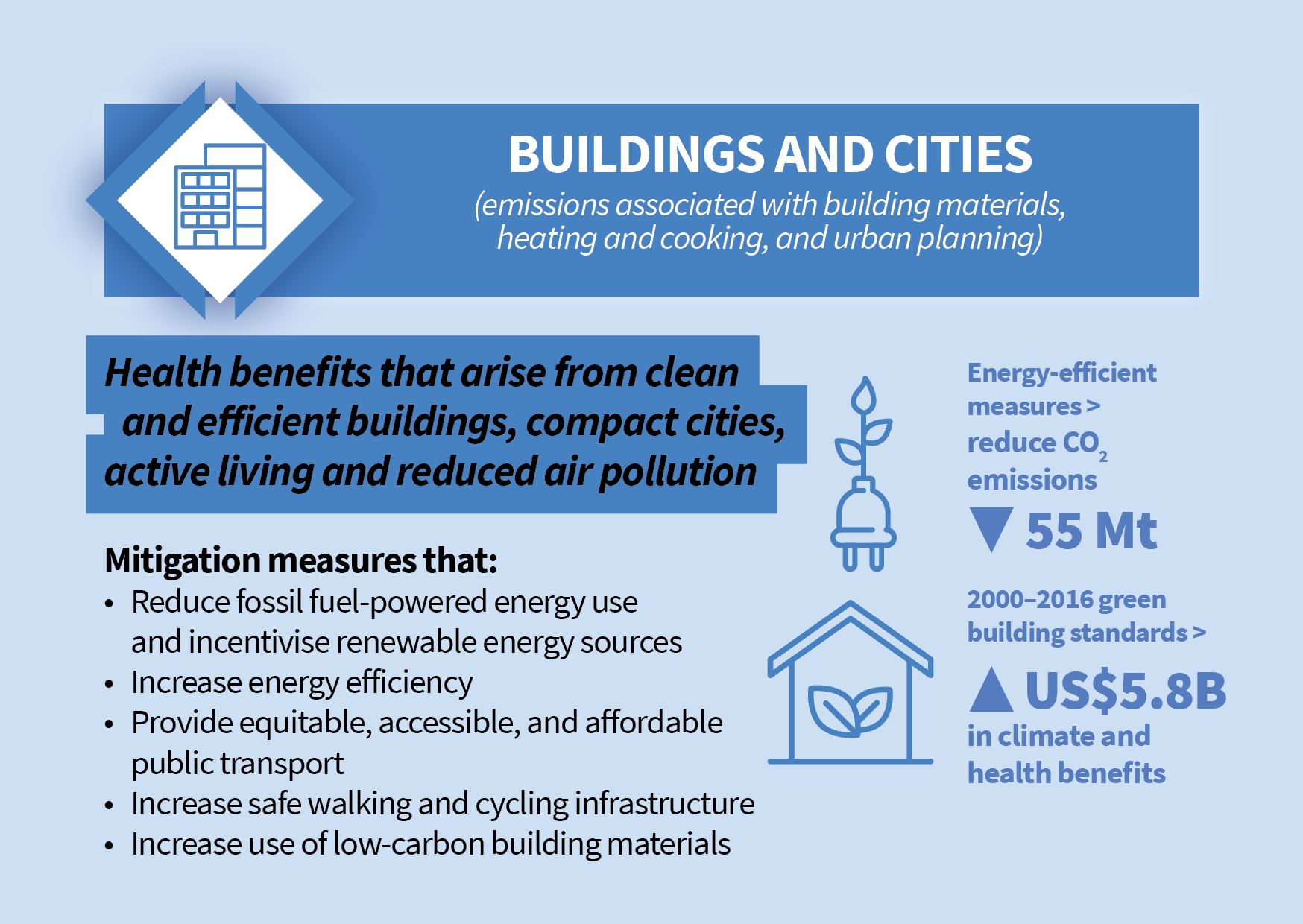

Multiple health benefits of climate mitigation measures - Source www.unimelb.edu.au

The guide meticulously examines the concept of carbon taxation, explaining how it assigns a financial penalty to carbon emissions generated by various human activities. This penalty encourages businesses and individuals to reduce their carbon footprint and seek cleaner energy sources. By internalizing the cost of pollution, carbon taxation effectively aligns economic incentives with environmental objectives, driving the transition towards a low-carbon economy.

Furthermore, the guide delves into the practical implementation of carbon taxation. It discusses different approaches, such as cap-and-trade systems and carbon pricing, highlighting their strengths and challenges. Additionally, real-life examples from countries that have implemented carbon taxation provide valuable insights into its effectiveness in reducing emissions and stimulating innovation in the clean energy sector.

The guide concludes by emphasizing the critical role carbon taxation plays in mitigating climate change. It acknowledges that while the design and implementation of carbon taxation policies can be complex and politically sensitive, the urgency of addressing climate change requires a concerted effort. By providing a comprehensive understanding of carbon taxation, the guide empowers policymakers, businesses, and individuals to make informed decisions and create a sustainable future.

Key Insights

- Carbon taxation is an effective tool to reduce greenhouse gas emissions and mitigate climate change.

- The implementation of carbon taxation can drive economic growth by stimulating innovation in clean energy technologies.

- International cooperation and knowledge sharing are essential for the successful implementation of carbon taxation worldwide.

Conclusion

The All-Encompassing Guide to Carbon Taxation offers a comprehensive understanding of this critical policy tool in the fight against climate change. By shedding light on its mechanisms, impacts, and real-world applications, the guide empowers stakeholders to make informed decisions and contribute to a sustainable future. Carbon taxation has the potential to transform the global energy landscape, reduce emissions, and create economic opportunities. As the urgency of climate change intensifies, the insights provided in this guide will prove invaluable in navigating the complex path towards a low-carbon future.

The guide's call to action is clear: collaboration, innovation, and sustained commitment are essential to harness the full potential of carbon taxation. By working together and embracing the principles outlined in this guide, we can create a sustainable world for generations to come. Let us rise to the challenge and embrace the transformative power of carbon taxation as a catalyst for a greener, more prosperous future.